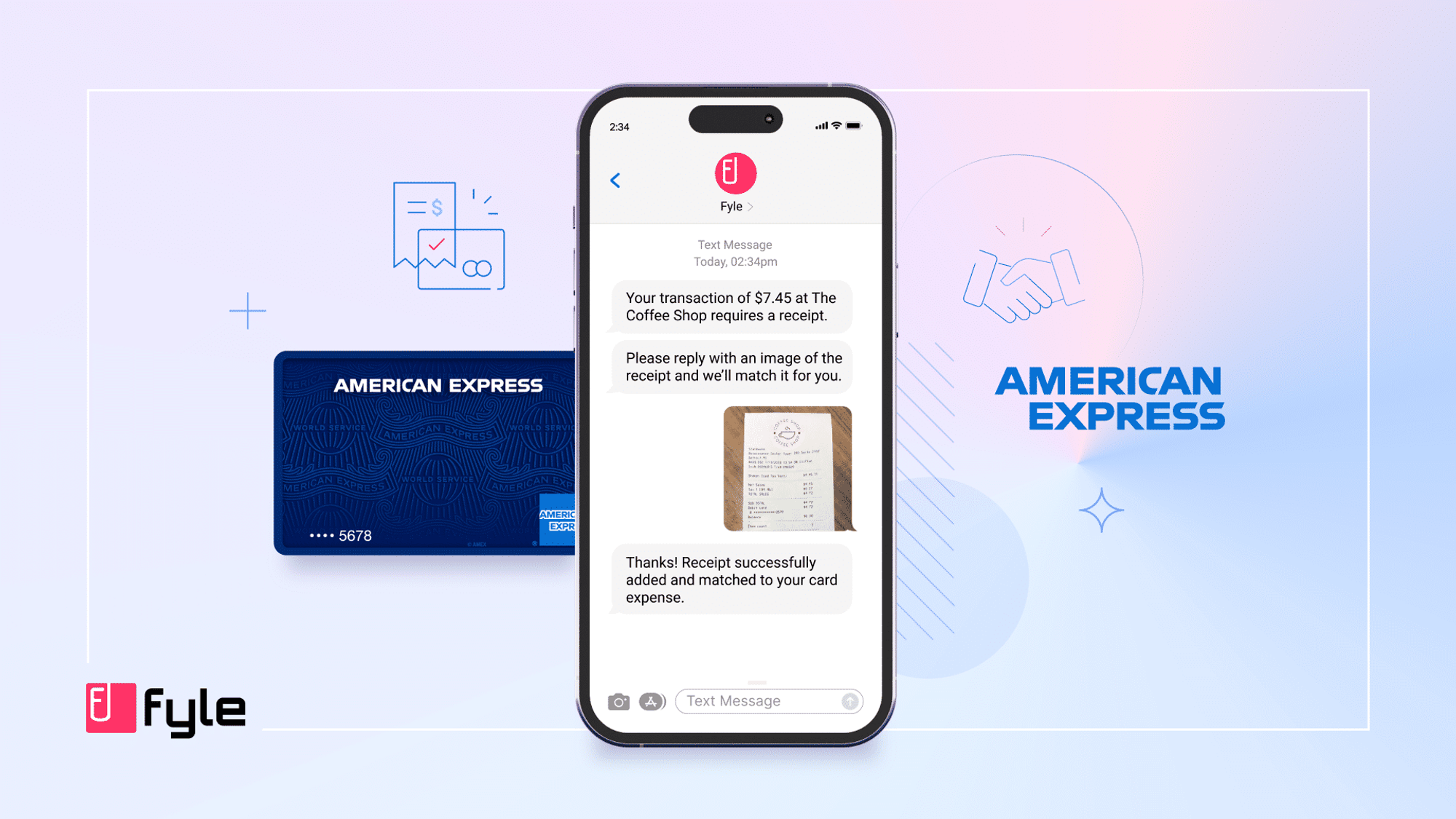

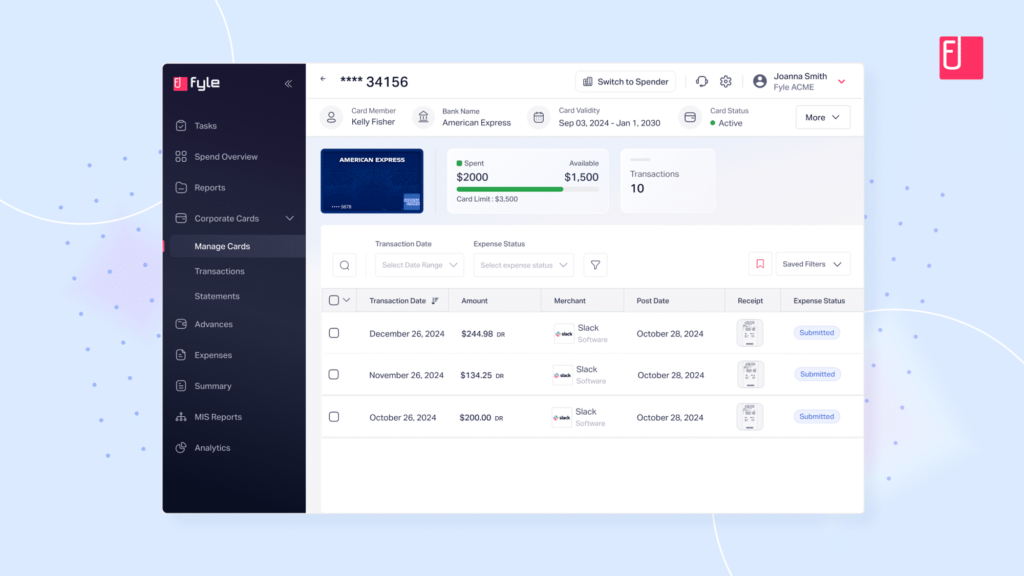

Fyle, a leading expense management platform, has exciting news for small business owners and working women across the United States. In a groundbreaking move, Fyle has announced its integration with American Express®, offering U.S. Business and Corporate Card Members the ability to issue on-demand virtual Cards through the Fyle platform. This collaboration brings many benefits, including enhanced security, control, and streamlined expense management, which will undoubtedly make life easier for small business owners and working women.

The integration with American Express® is a significant step forward for Fyle, enabling users to issue unlimited virtual Cards linked to their existing physical American Express® cards.

Here’s why this integration is a game-changer for small business owners and working women:

Enhanced Control: With the ability to establish specific controls for each on-demand virtual Card, users can set spending limits and expiration dates. This level of control ensures that expenses stay within budget and comply with company policies.

Optimized Cash Flow Management: Users can pay suppliers using virtual Cards and leverage their American Express® billing cycle to manage cash flow effectively until the Card payment is due. This feature provides greater flexibility in managing business finances.

Real-Time Visibility: Users receive real-time transaction data and notifications via text messages, offering maximum visibility into their spending and enabling proactive financial decisions.

✿ Thank you for reading!

Subscribe to be our bestie, no spam—just good vibes once a month.

Streamlined Expense Management: Fyle’s expense management platform automates receipt collection and accelerates the reconciliation process. Users can effortlessly track and categorize expenses, simplifying the entire accounting process.

Enhanced Security: The integration allows employees, freelancers, and subcontractors to make payments on behalf of the business without sharing physical Card details. This enhanced security feature safeguards against potential fraud or misuse.

Yashwanth Madhusudan, Co-Founder & CEO of Fyle, emphasized the value this integration brings to customers, stating, “We are teaming up with American Express to give our customers access to the control, enhanced security, and cash flow management that come with using an American Express virtual Card, alongside the ability to automate receipt tracking, credit card reconciliation, and expense accounting with Fyle. The integration helps us provide our customers an elevated user experience and more value.”

The integration has already gained praise from industry experts, with Joe Woodard, CEO of Woodard, commenting, “Fyle’s integration with American Express cards is different from anything else I have seen in the space. I’m excited to deploy it here at Woodard to increase security and spending controls.”

This collaboration between Fyle and American Express® represents a significant advancement in expense management for small businesses and working women. It offers a seamless and secure way to manage payments, expenses, and cash flow, ultimately enhancing financial control and efficiency.

About Fyle: Fyle is dedicated to reducing the time spent on expense management. Employees can easily submit receipts from everyday apps like Text Messaging, Gmail, Outlook, Slack, and more. Fyle’s AI-enabled engine instantly codes and categorizes data, assigns it to suitable projects and cost centers, and pushes the data to accounting software like NetSuite, Sage Intacct, QuickBooks Online, or Xero. Fyle directly integrates with your existing business credit cards to provide real-time transaction data and automated reconciliation, simplifying the expense management process.

✱ If you liked this article, please share it with a friend who could use inspiration.

If you have a topic in mind or a story to share anonymously or with your name, email us at [email protected]